SPOILER ALERT!

How To Differentiate Between A Good Public Insurance Adjusters and A Bad Public Insurers.

Content by-Schwartz Lerche

An Insurance coverage Adjuster, also called a Public Insurance adjuster, is typically a broker that is independent. You, the insurance holder, are normally represented by an Insurance coverage Agent. He or she serves exclusively for your passions and has no stake in any kind of insurance coverage firm. The insurance coverage company will generally appoint its own cases changing representative to manage its rate of interests solely. Nonetheless occasionally there are specific situations where the insurance claims insurance adjuster from a big firm is contacted to offer the passions of the insurance company. They are usually contacted to settle the insurance claims against an individual or a little company.

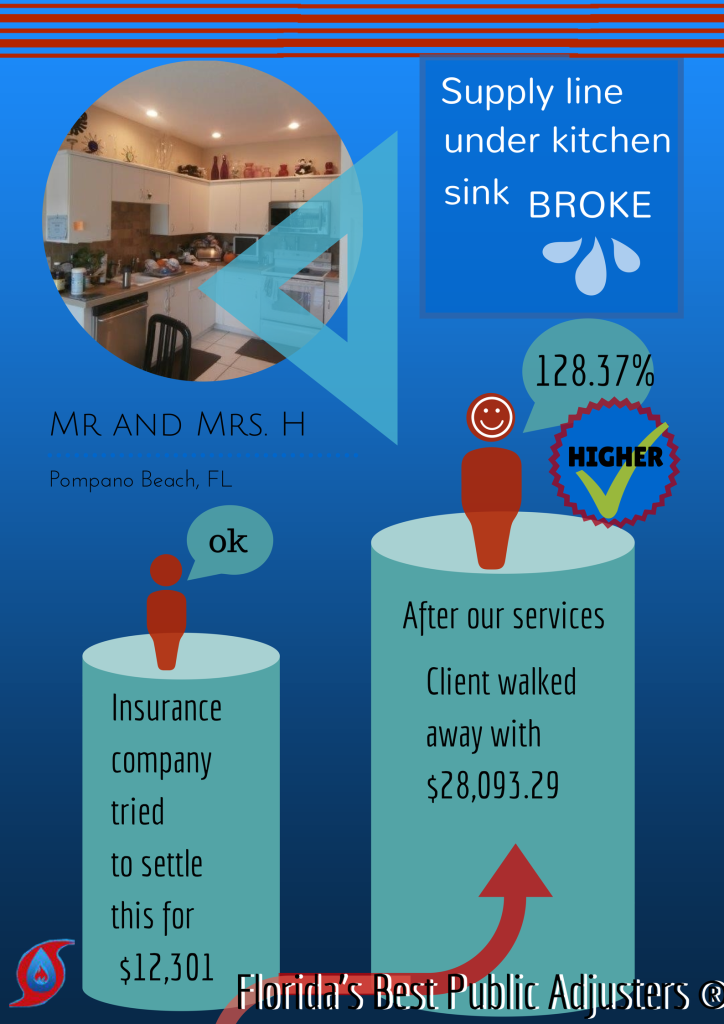

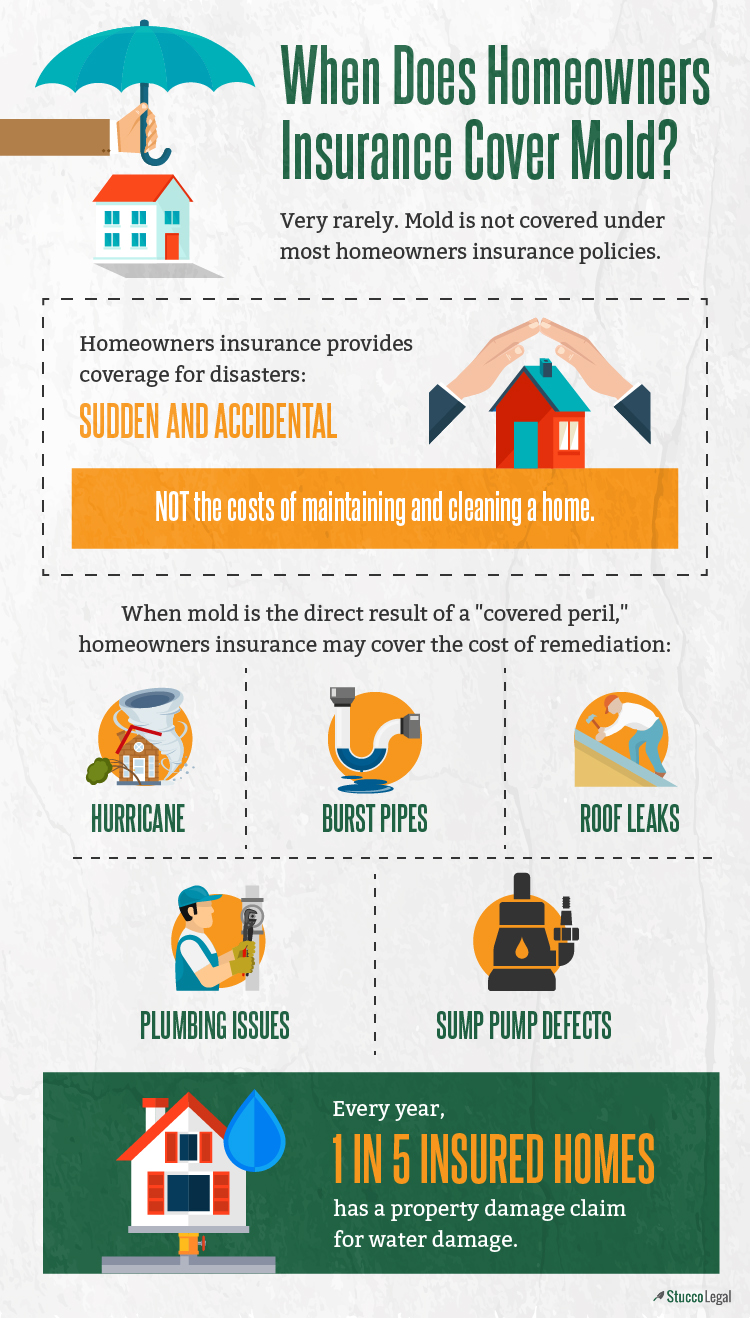

It is extremely essential that you have a great public insurer that can make the water damage restoration less complicated for you. An excellent public insurance adjuster knows just how to deal with the insurance provider. Insurance claims against you ought to be taken care of quickly to lessen any type of loss of time for you. In click the up coming post are discovering it difficult to manage your case be assured that an excellent public adjuster will certainly be helpful. He will have the needed experience and understanding to take care of the claims efficiently.

There are specific rules and regulations that you require to comply with to make sure that your insurance claim is resolved in a quick and appropriate way. A good public insurer has expertise about these rules and also laws. It is not smart to try negotiation by yourself since there is always a possibility that you may slip up or offer incorrect info to the company insurance adjuster. It is best to hand over this job to a reliable business insurer who recognizes with these procedures.

The most important part of the settlement process is the examination of the damaged property. When you hand over the duty of taking care of your insurance companies, they will most likely want to visit your home and also evaluate the damages to guarantee that you are making a case for the right damages. If there is damages to your home, the insured event will certainly be reliant pay for these fixings. Insurer usually like to take care of people who are proactive when it involves submitting insurance coverage cases and also helping them recoup their cash.

Insurance provider often tend to prefer employing a public adjuster because he or she has far more experience in this field than a representative does. They understand just how to manage all the paperwork involved in the cases procedure. The insurance company can additionally assign he or she to handle any other claims that you might have.

When you hire a public adjuster, there are some things that you need to be familiar with. Most notably, you require to disclose the nature of the insurance claim prior to the insurer does his work. Insurance companies prefer that you notify them regarding the nature of your claim when you begin making arrangements. This will make certain that they do not waste time in calling you for info pertaining to the situation as well as your determination to pay a lower fee.

If the company has to do any kind of investigation in your place, it would certainly cost you more cash as well as postpone the process. You should additionally keep in mind that the general public insurer will certainly not aid you with lawful guidance. This is the obligation of your lawyer or other insurance claims agent. The public insurer's job is restricted to gathering details and sending it to the insurance agent or your lawyer. You can not anticipate the public insurance adjuster to ask you any type of inquiries that connect to your case.

If you have made an insurance claim prior to and also you are still not pleased with the result, it is very important that you ought to let the general public adjuster recognize. This will certainly allow the insurance provider to make any changes that they require to prior to the following case. For the most part, your claim was denied but it may wind up with a modification due to the bad experience that you have had with the business. https://www.globenewswire.com/news-release/2020/10/27/2115030/28124/en/Global-Insurance-Third-Party-Administrators-Market-2020-2025-Focus-on-Healthcare-Providers-Retirement-Plans-Commercial-General-Liability.html is your right as a policyholder to have a great public insurance adjuster.

An Insurance coverage Adjuster, also called a Public Insurance adjuster, is typically a broker that is independent. You, the insurance holder, are normally represented by an Insurance coverage Agent. He or she serves exclusively for your passions and has no stake in any kind of insurance coverage firm. The insurance coverage company will generally appoint its own cases changing representative to manage its rate of interests solely. Nonetheless occasionally there are specific situations where the insurance claims insurance adjuster from a big firm is contacted to offer the passions of the insurance company. They are usually contacted to settle the insurance claims against an individual or a little company.

It is extremely essential that you have a great public insurer that can make the water damage restoration less complicated for you. An excellent public insurance adjuster knows just how to deal with the insurance provider. Insurance claims against you ought to be taken care of quickly to lessen any type of loss of time for you. In click the up coming post are discovering it difficult to manage your case be assured that an excellent public adjuster will certainly be helpful. He will have the needed experience and understanding to take care of the claims efficiently.

There are specific rules and regulations that you require to comply with to make sure that your insurance claim is resolved in a quick and appropriate way. A good public insurer has expertise about these rules and also laws. It is not smart to try negotiation by yourself since there is always a possibility that you may slip up or offer incorrect info to the company insurance adjuster. It is best to hand over this job to a reliable business insurer who recognizes with these procedures.

The most important part of the settlement process is the examination of the damaged property. When you hand over the duty of taking care of your insurance companies, they will most likely want to visit your home and also evaluate the damages to guarantee that you are making a case for the right damages. If there is damages to your home, the insured event will certainly be reliant pay for these fixings. Insurer usually like to take care of people who are proactive when it involves submitting insurance coverage cases and also helping them recoup their cash.

Insurance provider often tend to prefer employing a public adjuster because he or she has far more experience in this field than a representative does. They understand just how to manage all the paperwork involved in the cases procedure. The insurance company can additionally assign he or she to handle any other claims that you might have.

When you hire a public adjuster, there are some things that you need to be familiar with. Most notably, you require to disclose the nature of the insurance claim prior to the insurer does his work. Insurance companies prefer that you notify them regarding the nature of your claim when you begin making arrangements. This will make certain that they do not waste time in calling you for info pertaining to the situation as well as your determination to pay a lower fee.

If the company has to do any kind of investigation in your place, it would certainly cost you more cash as well as postpone the process. You should additionally keep in mind that the general public insurer will certainly not aid you with lawful guidance. This is the obligation of your lawyer or other insurance claims agent. The public insurer's job is restricted to gathering details and sending it to the insurance agent or your lawyer. You can not anticipate the public insurance adjuster to ask you any type of inquiries that connect to your case.

If you have made an insurance claim prior to and also you are still not pleased with the result, it is very important that you ought to let the general public adjuster recognize. This will certainly allow the insurance provider to make any changes that they require to prior to the following case. For the most part, your claim was denied but it may wind up with a modification due to the bad experience that you have had with the business. https://www.globenewswire.com/news-release/2020/10/27/2115030/28124/en/Global-Insurance-Third-Party-Administrators-Market-2020-2025-Focus-on-Healthcare-Providers-Retirement-Plans-Commercial-General-Liability.html is your right as a policyholder to have a great public insurance adjuster.

SPOILER ALERT!

Flood Insurance Policy Adjuster - How A Flooding Insurance Adjuster Can Aid You And Also Just How To Work with One?

Content writer-Tarp Li

A Public Insurer is an independent Insurance policy Insurer who is worked with by you to shield your rate of interests as a plan owner. He/she functions only for you as well as nothing else insurance organization. The insurance company does not assign its own adjusters to look after its passions. Therefore, Public Insurance adjusters are responsible for embarking on cases independently and arriving at negotiations that remain in your benefits. This means that they are needed to be dispassionate about the settlement that is practically to be set in between you as well as your insurance coverage service provider.

Why is it important that you locate a good public insurance adjuster? An excellent public adjuster will certainly make certain that he/she does not assign greater than 50% of the final negotiation to the initial party. The 2nd celebration is after that intended to pay back the balance. A good public insurance adjuster will additionally prevent a percent cut from the last negotiation, which you have to pay of your very own pocket. It is important to note that an excellent public insurer will not appoint greater than 50% of the settlement to the first party as well as will not appoint a percent cut from the last settlement to the second celebration.

How does a Public Insurance adjuster differ from a Company Insurance adjuster? Public Insurers works in a relatively unregulated setting. In many states, there is extremely little guideline over just how insurer readjust insurance claims. While this can be great for customers who can file claims without being afraid that their rights will be breached, it can also bring about abuses by companies when they do violate your civil liberties.

Insurance provider are not enabled to victimize individuals during a settlement. While this seems like common sense, numerous individuals have in fact undergone such therapy. For find out here , many individuals have actually been designated one insurance adjuster or one more to manage their insurance claim after an accident just to find that the insurance provider has made use of various kinds of harassment so as to get them to sign the negotiation. These methods include endangering to have you hospitalized if you do not agree with the negotiation, making embarrassing needs on you that you will not tell any person else or requiring you to sign a launch form that holds you harmless from any liability whatsoever. As you can see, these kinds of activities by adjusters can break federal and state regulations. As a result, public insurers should work really tough to ensure that they do not abuse their power.

Exactly how can a property owner protect themselves from violent activities by their insurance insurer? One method to do so is to hire a personal injury attorney that is experienced in handling such cases. A great attorney will ensure that your rights are shielded throughout the whole insurance claim process. One more way to guarantee that the insurer does not take advantage of you is to completely connect with them concerning what you are experiencing. This communication can be as straightforward as telling them that you prepare to talk to your insurance representative as well as giving them with a contact number to reach you at.

If you are able to talk with your insurer prior to they show up to examine your residential or commercial property, you must ask inquiries concerning their plans for the inspection. An excellent insurance adjuster will assess your property with a specialist in flood damage. They will examine to make certain that there are no indications of water damages or architectural damages, verify that all building regulations were adhered to, and conduct a stock of your personal belongings to determine the total expense of your loss. After the evaluation is over, your insurer ought to offer you a written price quote of the prices related to the problems. This price quote needs to include a malfunction of what each harmed item is worth as well as the complete buck amount due to your insurer for your loss.

If you wish to speak to your insurer straight prior to the general public Insurance adjuster gets here, it is important to prepare a list of the things damaged and also the estimated worth of each along with just how much the complete price will be. Be prepared to supply the name of each private product, along with a detailed description. https://www.chicagotribune.com/suburbs/post-tribune/opinion/ct-ptb-davich-house-fire-public-adjuster-role-st-0723-story.html is likewise a good suggestion to have actually duplicates constructed from any kind of photos you can get of your house after the flood damages. When you employ a professional to examine the loss that you have actually experienced, you should anticipate to pay the full market value for your products. In most states, this means the entire retail cost of your ownerships.

If you decide to dispute the case, you ought to obtain copies of every one of the invoices that you will certainly require to show the loss on your insurance coverage. It is important for your insurance adjuster to have this paperwork so he or she has a record of what you are claiming. After your claim has actually been approved, your insurance insurer will certainly send you a check for the negotiation quantity. You should send this check straight to your insurer so it can be moneyed in the exact same day you obtain the cash. If you have any remaining uncertainties about the case being valid, you should call your insurance company to discuss the information additionally.

A Public Insurer is an independent Insurance policy Insurer who is worked with by you to shield your rate of interests as a plan owner. He/she functions only for you as well as nothing else insurance organization. The insurance company does not assign its own adjusters to look after its passions. Therefore, Public Insurance adjusters are responsible for embarking on cases independently and arriving at negotiations that remain in your benefits. This means that they are needed to be dispassionate about the settlement that is practically to be set in between you as well as your insurance coverage service provider.

Why is it important that you locate a good public insurance adjuster? An excellent public adjuster will certainly make certain that he/she does not assign greater than 50% of the final negotiation to the initial party. The 2nd celebration is after that intended to pay back the balance. A good public insurance adjuster will additionally prevent a percent cut from the last negotiation, which you have to pay of your very own pocket. It is important to note that an excellent public insurer will not appoint greater than 50% of the settlement to the first party as well as will not appoint a percent cut from the last settlement to the second celebration.

How does a Public Insurance adjuster differ from a Company Insurance adjuster? Public Insurers works in a relatively unregulated setting. In many states, there is extremely little guideline over just how insurer readjust insurance claims. While this can be great for customers who can file claims without being afraid that their rights will be breached, it can also bring about abuses by companies when they do violate your civil liberties.

Insurance provider are not enabled to victimize individuals during a settlement. While this seems like common sense, numerous individuals have in fact undergone such therapy. For find out here , many individuals have actually been designated one insurance adjuster or one more to manage their insurance claim after an accident just to find that the insurance provider has made use of various kinds of harassment so as to get them to sign the negotiation. These methods include endangering to have you hospitalized if you do not agree with the negotiation, making embarrassing needs on you that you will not tell any person else or requiring you to sign a launch form that holds you harmless from any liability whatsoever. As you can see, these kinds of activities by adjusters can break federal and state regulations. As a result, public insurers should work really tough to ensure that they do not abuse their power.

Exactly how can a property owner protect themselves from violent activities by their insurance insurer? One method to do so is to hire a personal injury attorney that is experienced in handling such cases. A great attorney will ensure that your rights are shielded throughout the whole insurance claim process. One more way to guarantee that the insurer does not take advantage of you is to completely connect with them concerning what you are experiencing. This communication can be as straightforward as telling them that you prepare to talk to your insurance representative as well as giving them with a contact number to reach you at.

If you are able to talk with your insurer prior to they show up to examine your residential or commercial property, you must ask inquiries concerning their plans for the inspection. An excellent insurance adjuster will assess your property with a specialist in flood damage. They will examine to make certain that there are no indications of water damages or architectural damages, verify that all building regulations were adhered to, and conduct a stock of your personal belongings to determine the total expense of your loss. After the evaluation is over, your insurer ought to offer you a written price quote of the prices related to the problems. This price quote needs to include a malfunction of what each harmed item is worth as well as the complete buck amount due to your insurer for your loss.

If you wish to speak to your insurer straight prior to the general public Insurance adjuster gets here, it is important to prepare a list of the things damaged and also the estimated worth of each along with just how much the complete price will be. Be prepared to supply the name of each private product, along with a detailed description. https://www.chicagotribune.com/suburbs/post-tribune/opinion/ct-ptb-davich-house-fire-public-adjuster-role-st-0723-story.html is likewise a good suggestion to have actually duplicates constructed from any kind of photos you can get of your house after the flood damages. When you employ a professional to examine the loss that you have actually experienced, you should anticipate to pay the full market value for your products. In most states, this means the entire retail cost of your ownerships.

If you decide to dispute the case, you ought to obtain copies of every one of the invoices that you will certainly require to show the loss on your insurance coverage. It is important for your insurance adjuster to have this paperwork so he or she has a record of what you are claiming. After your claim has actually been approved, your insurance insurer will certainly send you a check for the negotiation quantity. You should send this check straight to your insurer so it can be moneyed in the exact same day you obtain the cash. If you have any remaining uncertainties about the case being valid, you should call your insurance company to discuss the information additionally.

SPOILER ALERT!

Where You Can Discover a Public Insurance Coverage Insurance Adjuster That Can Aid You With Your Insurance Case?

https://www.propertycasualty360.com/2020/10/22/in-bi-claims-minutia-could-mean-millions/ -Udsen Geertsen

Claims adjusters or public insurance coverage adjusters are qualified reps of their state insurance coverage department. Public representatives help both customers as well as the state insurance divisions. Public representatives are the only insurance coverage case experts who function solely in behalf of the policyholder.

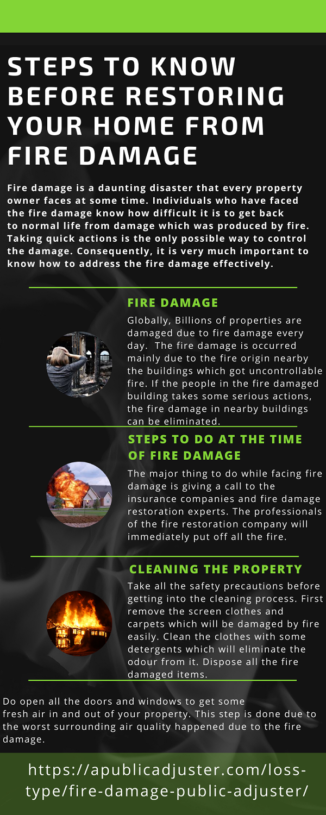

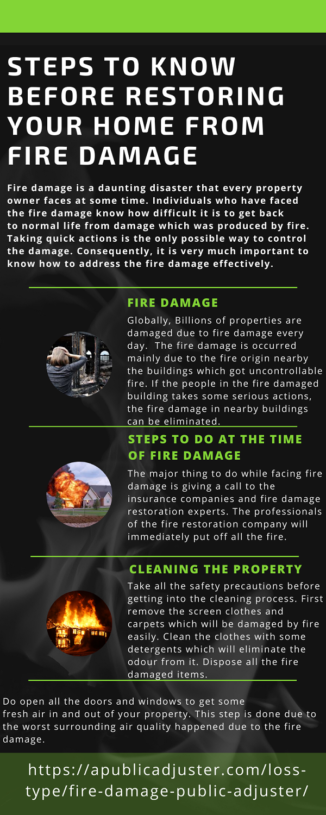

Claims for fire, wind, smoke, earthquake as well as other catastrophe damages, can all be filed as well as worked out by public insurance coverage insurers. Claims can likewise be filed when there is a consumer item liability, building damages or injury cases. Claims made by consumers for injury will certainly be refined by cases adjustors who have a permit from their state insurance coverage division. Insurance claims from customers and also insurance companies will usually include injuries that take place at the workplace, on the highway, at home or in a task like leisure. Cases from businesses will certainly include injuries that happen at their place of business.

The insurance company of the client will call the Public Insurance adjuster for a pre-settlement assessment. Throughout the speak with, the Public Insurance adjuster will certainly gather information from the customer, including names, addresses, contact number and also other appropriate information. Insurance coverage Insurance adjuster will certainly after that perform an assessment of the facilities to figure out if they are risk-free. Hereafter, a composed case amount will be submitted to the homeowner. Insurance coverage Insurer will assist in aiding home owners send the appropriate documentation needed to submit the claim amount to the respective state insurance coverage division.

Insurance Adjusters will function directly with home owners as well as the matching state insurance policy division to assist both events to settle their case claims. Public adjusters will often likewise work straight with insurance policy representatives. Public representatives and insurance coverage agents can both do administrative collaborate with home owners. Public insurance adjusters have to work directly with the customer to process their insurance policy claims.

Insurer will often use Public Insurers. Many insurance companies have their very own representatives that are appointed by the business to serve the business. Public insurance adjusters work in conjunction with insurer and also the respective state to resolve insurance coverage cases on behalf of the client. In order to end up being an independent insurer, one have to participate in as well as pass examinations performed by the American Culture of Public Insurance Coverage Professionals. Once an independent insurance adjuster has actually finished and also passed the assessments, they need to function under the guidance of an insurer to become an agent.

Insurance companies will pay Public Insurance adjusters a portion of the negotiation quantity if the insurance claim succeeds. Insurer will certainly decide if the negotiation will be higher or less than the last negotiation amount by using various variables. These factors consist of the nature of the injury, timing of the case, the risk of the negotiation not being paid out, and also the extent of damage. get more info operates in conjunction with the courts, along with insurance adjuster lawyers. The courts assign them particular situations to identify the last quantity of payment that will certainly be paid. Insurance provider use Public Insurers to help them in the correct settlement of cases.

Public Insurance adjusters will frequently deal with all facets of the insurance claim, starting with establishing whether the insurance claim is a legitimate insurance claim, and afterwards making certain it receives the ideal negotiation from the insurance company. Public Adjusters will certainly likewise check out any kind of dubious scenarios surrounding the mishap. After finding all dubious conditions, the Public Insurer will certainly make certain that the insurance claim is submitted to the ideal court. In addition to helping the client with the settlement, the Public Adjuster will certainly additionally help them with all necessary repair services. Most of these tasks are consisted of in the 'service contract' that you have with the Insurance provider, however the general public Insurance adjuster generally makes recommendations for additional work. If the customer selects to hire their own legal representative, the Public Insurer will help them with this procedure.

Public Insurance adjusters is extremely helpful to any person who needs to send a claim to insurance companies or insurance coverage. They can identify if the insurance claim is valid and what damages (if any type of) should be offered to the client. They might be needed to see the site of the accident, check the website after hrs, or carry out other jobs beyond their regular work tasks to make sure appropriate compliance with all appropriate laws and policies. Many insurance representatives suggest that individuals not hire Public Insurers to manage their claims alone, however instead let them handle the circumstance themselves so they can concentrate on supplying quality customer service.

Claims adjusters or public insurance coverage adjusters are qualified reps of their state insurance coverage department. Public representatives help both customers as well as the state insurance divisions. Public representatives are the only insurance coverage case experts who function solely in behalf of the policyholder.

Claims for fire, wind, smoke, earthquake as well as other catastrophe damages, can all be filed as well as worked out by public insurance coverage insurers. Claims can likewise be filed when there is a consumer item liability, building damages or injury cases. Claims made by consumers for injury will certainly be refined by cases adjustors who have a permit from their state insurance coverage division. Insurance claims from customers and also insurance companies will usually include injuries that take place at the workplace, on the highway, at home or in a task like leisure. Cases from businesses will certainly include injuries that happen at their place of business.

The insurance company of the client will call the Public Insurance adjuster for a pre-settlement assessment. Throughout the speak with, the Public Insurance adjuster will certainly gather information from the customer, including names, addresses, contact number and also other appropriate information. Insurance coverage Insurance adjuster will certainly after that perform an assessment of the facilities to figure out if they are risk-free. Hereafter, a composed case amount will be submitted to the homeowner. Insurance coverage Insurer will assist in aiding home owners send the appropriate documentation needed to submit the claim amount to the respective state insurance coverage division.

Insurance Adjusters will function directly with home owners as well as the matching state insurance policy division to assist both events to settle their case claims. Public adjusters will often likewise work straight with insurance policy representatives. Public representatives and insurance coverage agents can both do administrative collaborate with home owners. Public insurance adjusters have to work directly with the customer to process their insurance policy claims.

Insurer will often use Public Insurers. Many insurance companies have their very own representatives that are appointed by the business to serve the business. Public insurance adjusters work in conjunction with insurer and also the respective state to resolve insurance coverage cases on behalf of the client. In order to end up being an independent insurer, one have to participate in as well as pass examinations performed by the American Culture of Public Insurance Coverage Professionals. Once an independent insurance adjuster has actually finished and also passed the assessments, they need to function under the guidance of an insurer to become an agent.

Insurance companies will pay Public Insurance adjusters a portion of the negotiation quantity if the insurance claim succeeds. Insurer will certainly decide if the negotiation will be higher or less than the last negotiation amount by using various variables. These factors consist of the nature of the injury, timing of the case, the risk of the negotiation not being paid out, and also the extent of damage. get more info operates in conjunction with the courts, along with insurance adjuster lawyers. The courts assign them particular situations to identify the last quantity of payment that will certainly be paid. Insurance provider use Public Insurers to help them in the correct settlement of cases.

Public Insurance adjusters will frequently deal with all facets of the insurance claim, starting with establishing whether the insurance claim is a legitimate insurance claim, and afterwards making certain it receives the ideal negotiation from the insurance company. Public Adjusters will certainly likewise check out any kind of dubious scenarios surrounding the mishap. After finding all dubious conditions, the Public Insurer will certainly make certain that the insurance claim is submitted to the ideal court. In addition to helping the client with the settlement, the Public Adjuster will certainly additionally help them with all necessary repair services. Most of these tasks are consisted of in the 'service contract' that you have with the Insurance provider, however the general public Insurance adjuster generally makes recommendations for additional work. If the customer selects to hire their own legal representative, the Public Insurer will help them with this procedure.

Public Insurance adjusters is extremely helpful to any person who needs to send a claim to insurance companies or insurance coverage. They can identify if the insurance claim is valid and what damages (if any type of) should be offered to the client. They might be needed to see the site of the accident, check the website after hrs, or carry out other jobs beyond their regular work tasks to make sure appropriate compliance with all appropriate laws and policies. Many insurance representatives suggest that individuals not hire Public Insurers to manage their claims alone, however instead let them handle the circumstance themselves so they can concentrate on supplying quality customer service.

SPOILER ALERT!

What Is A Public Insurance adjuster And Just How Do I Hire One?

Authored by-Vest Simpson

Do you understand what an insurance insurer is? Have you ever came across an insurance insurer before? What can they provide for you? Just how do they assist you? These are simply a few of the concerns you may have while you read this short article about Public Insurance adjusters, Insurance Coverage Insurance Adjusters and also Cases Adjusters.

First, it is essential to recognize what exactly are Public Adjusters? If you have been making insurance claims in the past, the cases insurance adjuster you have actually had benefiting you is a Public Insurance adjuster. If you are wanting to utilize the services of an insurance policy claim adjuster, they are normally described as Public Adjusters and also are experienced in aiding clients who have been in crashes. You will find that there are many individuals who describe Public Adjusters as Insurance coverage Adjusters too.

Claims Adjusters adjust claims that have been sent by the customer or by one more person related to the insurance case. For example, if you have been making insurance coverage claims, you might want to get an insurance claims insurer to aid you. When you call the insurance claims insurance adjuster you might talk with them on the phone or satisfy them face to face. It is essential to remember that declares insurers are independent professionals, not to be connected with any type of one certain insurance provider or representative.

What does Public Insurance adjusters provide for you? They make changes to the settlement amount to see to it the customer's insurance claim is gotten in a reasonable and simply fashion. In addition to this, insurers are in charge of gathering all of the settlement amounts for you or your adjuster, unless the situation is cleared up outside of their office. Cases adjustors should submit a report with the Insurance Company within 45 days of getting your case. This will certainly ensure that they recognize what your settlement amount is and if they are in charge of gathering it.

Public Insurance adjusters is essential when it concerns water damage insurance claims due to the fact that often you do not have time to prepare a practical insurance claim settlement. Public Adjusters can aid you figure out the correct amount of water damage to examine the problems to your house, building, as well as personal items. In addition, public insurance adjusters are in charge of accumulating every one of the settlement amounts for you or your adjuster, unless the situation is worked out outside of their office.

Are you taking into consideration hiring a Public Adjuster to assist you with your water damages insurance claims? Public Insurance adjusters can aid you by supplying useful information that can be important when it involves filing a successful case with your insurance provider. For example, you need to employ an adjuster if: you've experienced flooding; or, you have actually experienced a leakage. Additionally, they can also aid with filing all required documentation with your adjuster. Public Insurers typically services a backup basis, so it is very important to remember that your insurance provider might not pay all or several of the expenses related to the repair services.

What should you do prior to you work with a Public Insurance adjuster to assist you in your claim? First, you need to set up a consultation with your insurance provider. https://www.tallahassee.com/story/news/local/state/2021/02/05/lawmakers-lax-state-enforcement-allowing-florida-homeowner-insurance-fraud-hurricane-flood/4351929001/ will certainly examine the extent of the damage after evaluating your insurance plan. Next, you must set up a consultation to review the repair services with the Public Adjuster. This will enable the insurance adjuster to examine the full extent of your case based upon the details they are offered. Lastly, you must set up a visit to talk with the Public Adjuster regarding your personal insurance policy.

Public Insurers is generally appointed on a contingent basis. In this situation, you would have the insurer to represent your rate of interests throughout the insurance claim process. What this indicates is that you would have the capability to pick whether to keep the services of the insurance adjuster or if you want to take care of the whole claim process yourself. This choice must be made along with your insurance policy agent. Once the Public Insurer has actually reviewed your claim and also everything is in order, you can after that talk about the next steps with your insurance policy representative.

Do you understand what an insurance insurer is? Have you ever came across an insurance insurer before? What can they provide for you? Just how do they assist you? These are simply a few of the concerns you may have while you read this short article about Public Insurance adjusters, Insurance Coverage Insurance Adjusters and also Cases Adjusters.

First, it is essential to recognize what exactly are Public Adjusters? If you have been making insurance claims in the past, the cases insurance adjuster you have actually had benefiting you is a Public Insurance adjuster. If you are wanting to utilize the services of an insurance policy claim adjuster, they are normally described as Public Adjusters and also are experienced in aiding clients who have been in crashes. You will find that there are many individuals who describe Public Adjusters as Insurance coverage Adjusters too.

Claims Adjusters adjust claims that have been sent by the customer or by one more person related to the insurance case. For example, if you have been making insurance coverage claims, you might want to get an insurance claims insurer to aid you. When you call the insurance claims insurance adjuster you might talk with them on the phone or satisfy them face to face. It is essential to remember that declares insurers are independent professionals, not to be connected with any type of one certain insurance provider or representative.

What does Public Insurance adjusters provide for you? They make changes to the settlement amount to see to it the customer's insurance claim is gotten in a reasonable and simply fashion. In addition to this, insurers are in charge of gathering all of the settlement amounts for you or your adjuster, unless the situation is cleared up outside of their office. Cases adjustors should submit a report with the Insurance Company within 45 days of getting your case. This will certainly ensure that they recognize what your settlement amount is and if they are in charge of gathering it.

Public Insurance adjusters is essential when it concerns water damage insurance claims due to the fact that often you do not have time to prepare a practical insurance claim settlement. Public Adjusters can aid you figure out the correct amount of water damage to examine the problems to your house, building, as well as personal items. In addition, public insurance adjusters are in charge of accumulating every one of the settlement amounts for you or your adjuster, unless the situation is worked out outside of their office.

Are you taking into consideration hiring a Public Adjuster to assist you with your water damages insurance claims? Public Insurance adjusters can aid you by supplying useful information that can be important when it involves filing a successful case with your insurance provider. For example, you need to employ an adjuster if: you've experienced flooding; or, you have actually experienced a leakage. Additionally, they can also aid with filing all required documentation with your adjuster. Public Insurers typically services a backup basis, so it is very important to remember that your insurance provider might not pay all or several of the expenses related to the repair services.

What should you do prior to you work with a Public Insurance adjuster to assist you in your claim? First, you need to set up a consultation with your insurance provider. https://www.tallahassee.com/story/news/local/state/2021/02/05/lawmakers-lax-state-enforcement-allowing-florida-homeowner-insurance-fraud-hurricane-flood/4351929001/ will certainly examine the extent of the damage after evaluating your insurance plan. Next, you must set up a consultation to review the repair services with the Public Adjuster. This will enable the insurance adjuster to examine the full extent of your case based upon the details they are offered. Lastly, you must set up a visit to talk with the Public Adjuster regarding your personal insurance policy.

Public Insurers is generally appointed on a contingent basis. In this situation, you would have the insurer to represent your rate of interests throughout the insurance claim process. What this indicates is that you would have the capability to pick whether to keep the services of the insurance adjuster or if you want to take care of the whole claim process yourself. This choice must be made along with your insurance policy agent. Once the Public Insurer has actually reviewed your claim and also everything is in order, you can after that talk about the next steps with your insurance policy representative.

SPOILER ALERT!

What Does A Public Adjuster Does And Also Just How Can He Work To You?

Created by-Kjellerup Geertsen

An insurance coverage sales agent can be rather a very useful consultant to numerous insurance coverage customers as well as belongs to the group that is called the general public insurer. Many are not knowledgeable about precisely what the work of the adjuster actually involves. Put simply, asserts insurance adjusters exist to see to it that the consumer's insurance policy requirements are fulfilled. Insurance policy agents call them adjusters or brokers. Right here's a closer check out what these people perform in a day in the workplace:

- Examine the legitimacy - The whole procedure starts with a claim being submitted with the business that releases the plan. At this point, the insurance provider will assess the case and validate if it is a valid one. If it is valid, the insurance holder will be given a letter from the insurer to send to the various other celebration to compensate or obtain re-checked within a specified amount of time. Subsequently, the various other party will return a letter claiming if the case is valid or otherwise.

- Gauging the damages - After the firm obtains the case, the general public Adjuster will certainly examine it and will start accumulating evidence. In some cases, an insured individual will require to come in and also actually see the damage so as to get a decision. When all of the evidence has been accumulated by the agent, they will ask for a momentary quote of the complete quantity of cash required to repay the insurance claim. At this moment, the insured may employ the services of a public insurance adjuster or he might choose to sue with the Insurance policy Division of the State or National Insurance Policy Stats.

- Suggestions from insured - When every one of the evidence remains in order, the general public Insurer will certainly take it to the following step and will certainly provide guidance to the guaranteed. https://www.law.com/dailybusinessreview/2019/12/17/court-public-adjuster-not-disinterested-appraiser-for-homeowner/ has the ability to tell the insured how much the insurance should pay. If the insurance adjuster really feels that the situation is valid, he may suggest that the situation be explored by an insurance adjuster that will certainly be independent from the Insurance coverage Division. Now, if the situation needs additional investigation, the general public Insurer will certainly help the insurer by obtaining more info and also information.

The adjusters have the power to check out just how the insurance provider has actually resolved past cases. They can check out points like the variety of rejections and the nature of those rejections. This is made use of by the insurers to establish whether or not a company's insurance coverage are actually legitimate or not. The general public Insurance adjuster will likewise consider the kinds of losses that took place and will utilize this information to identify just how to take care of future claims.

As part of the role of the general public insurance coverage adjuster, he/she should likewise keep a relationship with national as well as state supervisors of insurance provider. They have to have the ability to make recommendations to these directors concerning any type of issues submitted against them. The Public Insurance adjuster have to additionally maintain documents on all communication that he/she receives from the companies. By doing this, the Public Adjuster can ensure that all document is precise. The documents that he/she must keep consist of the firm's address, telephone number, telephone number, and insurance provider's address. He/she should be really extensive in his/her documents due to the fact that if there is ever before a trouble with a record, it will be easy for him/her to fix it since it remains in the general public document.

The Public Adjuster is a vital part of the Insurance coverage Division. Insurance coverage agents no longer require to fret about the Public Insurer. If there ever becomes a need to examine an insurance policy case, insurance coverage representatives can get in touch with the Public Insurer to manage it. Public Insurance adjusters has lots of tasks and also obligations, and he/she is well worth the task.

In order to make certain that the Insurance coverage Division is doing their job, there has been a demand for insurance policy representatives to complete a Public Insurer Type annually. https://www.forbes.com/advisor/homeowners-insurance/does-homeowners-insurance-cover-mold/ is offered at their office or can conveniently be gotten online. To ensure that this does not occur once again, insurance agents should comply with every one of the laws set forth in The Insurance policy Treatment Act.

An insurance coverage sales agent can be rather a very useful consultant to numerous insurance coverage customers as well as belongs to the group that is called the general public insurer. Many are not knowledgeable about precisely what the work of the adjuster actually involves. Put simply, asserts insurance adjusters exist to see to it that the consumer's insurance policy requirements are fulfilled. Insurance policy agents call them adjusters or brokers. Right here's a closer check out what these people perform in a day in the workplace:

- Examine the legitimacy - The whole procedure starts with a claim being submitted with the business that releases the plan. At this point, the insurance provider will assess the case and validate if it is a valid one. If it is valid, the insurance holder will be given a letter from the insurer to send to the various other celebration to compensate or obtain re-checked within a specified amount of time. Subsequently, the various other party will return a letter claiming if the case is valid or otherwise.

- Gauging the damages - After the firm obtains the case, the general public Adjuster will certainly examine it and will start accumulating evidence. In some cases, an insured individual will require to come in and also actually see the damage so as to get a decision. When all of the evidence has been accumulated by the agent, they will ask for a momentary quote of the complete quantity of cash required to repay the insurance claim. At this moment, the insured may employ the services of a public insurance adjuster or he might choose to sue with the Insurance policy Division of the State or National Insurance Policy Stats.

- Suggestions from insured - When every one of the evidence remains in order, the general public Insurer will certainly take it to the following step and will certainly provide guidance to the guaranteed. https://www.law.com/dailybusinessreview/2019/12/17/court-public-adjuster-not-disinterested-appraiser-for-homeowner/ has the ability to tell the insured how much the insurance should pay. If the insurance adjuster really feels that the situation is valid, he may suggest that the situation be explored by an insurance adjuster that will certainly be independent from the Insurance coverage Division. Now, if the situation needs additional investigation, the general public Insurer will certainly help the insurer by obtaining more info and also information.

The adjusters have the power to check out just how the insurance provider has actually resolved past cases. They can check out points like the variety of rejections and the nature of those rejections. This is made use of by the insurers to establish whether or not a company's insurance coverage are actually legitimate or not. The general public Insurance adjuster will likewise consider the kinds of losses that took place and will utilize this information to identify just how to take care of future claims.

As part of the role of the general public insurance coverage adjuster, he/she should likewise keep a relationship with national as well as state supervisors of insurance provider. They have to have the ability to make recommendations to these directors concerning any type of issues submitted against them. The Public Insurance adjuster have to additionally maintain documents on all communication that he/she receives from the companies. By doing this, the Public Adjuster can ensure that all document is precise. The documents that he/she must keep consist of the firm's address, telephone number, telephone number, and insurance provider's address. He/she should be really extensive in his/her documents due to the fact that if there is ever before a trouble with a record, it will be easy for him/her to fix it since it remains in the general public document.

The Public Adjuster is a vital part of the Insurance coverage Division. Insurance coverage agents no longer require to fret about the Public Insurer. If there ever becomes a need to examine an insurance policy case, insurance coverage representatives can get in touch with the Public Insurer to manage it. Public Insurance adjusters has lots of tasks and also obligations, and he/she is well worth the task.

In order to make certain that the Insurance coverage Division is doing their job, there has been a demand for insurance policy representatives to complete a Public Insurer Type annually. https://www.forbes.com/advisor/homeowners-insurance/does-homeowners-insurance-cover-mold/ is offered at their office or can conveniently be gotten online. To ensure that this does not occur once again, insurance agents should comply with every one of the laws set forth in The Insurance policy Treatment Act.

SPOILER ALERT!

Just how Does A Public Insurance Adjuster Can Help You With Your Insurance claim?

Article created by-Vest Dyhr

If you are associated with a car accident that was not your fault, you may be entitled to obtain payment from a Public Insurer. You can get payment from the Insurance coverage Department, even if you were not responsible. It is always recommended that you consult with an Insurance policy Representative prior to making any choices concerning your claim. They can assist you via the cases process and aid you understand just how the procedure works.

Insurance policy Representatives are accredited by the state to work as Public Adjusters. You, the insurance holder, are assigned by the insurer to serve as the general public Insurer. She or he works exclusively for you and also has definitely no connections to the insurance provider. Consequently, the insurance provider will usually assign its best adjuster to handle its claims.

Insurance Agents have to adhere to strict rules and also laws. If you have concerns worrying an insurance claim, you must guide them to the insurance claims department. You should supply correct recognition as well as supply duplicates of records such as your insurance coverage, invoices, and so on. In addition, you must continue to be calm and also cooperative and also do not chew out the insurer. A good public adjuster will help you with these points and keep you educated.

Public Adjusters will evaluate your insurance claim and take action in a timely fashion. Insurance Companies want to resolve as quick as feasible due to the fact that they do not want to have to pay the excess expenses related to extensive lawsuits. Insurer hire qualified public insurers on a part-time or permanent basis. Part time workers will be in charge of cases, while full-time workers will concentrate on working as many insurance claims as feasible. Most notably, a good public insurance adjuster has access to the right get in touches with as well as will utilize this expertise to negotiate lower payment on your behalf.

If you are taking into consideration making use of the services of an expert public adjuster, ask to examine recommendations. See to it that they have a proven performance history of exceptional customer service. Inspect their client checklist to guarantee that they have had a good settlement price in the past. You must additionally examine referrals from other clients that are satisfied with their solutions.

Once you have actually chosen to collaborate with a reliable cases insurance adjuster, make certain to connect consistently with your insurer. Educate the insurance adjuster of any kind of changes that may take place throughout the procedure. Maintain all interaction lines open with your insurance provider. Likewise, ensure that you really feel comfortable allowing your insurance adjuster know of any kind of worries that you have. The good public insurers will certainly always pay attention to your concerns and provide you comprehensive suggestions. If you are having trouble connecting with your insurance adjuster, it is necessary that you discover a person that wants and able to connect well with you.

Some insurer like to employ real loss adjusters over independent brokers. https://www.sun-sentinel.com/business/fl-bz-hurricane-insurance-myths-and-facts-20180509-story.html is because they really feel more comfy recognizing that the broker is benefiting the insurance company rather than a specific claim adjuster. However, when an insurer hires a real loss adjuster, they retain the rights to use him or her in any type of future dealings with your insurance company. For the most part, if you are handling an independent broker, she or he is not the same person who will certainly be managing your insurance claim. This indicates that an independent broker can not provide you suggestions concerning your real loss scenario.

If you choose to collaborate with a professional public insurance adjuster, it is very important that you give them time to prepare your claim. The adjuster will usually request a detailed list of your home losses prior to they start dealing with your claim. They will also examine your insurance plan to make sure that the negotiation deal is fair as well as practical. If visit the following page is not appropriate to you, the insurance adjuster will likely ask for more time to gather info and create a suitable offer.

If you are associated with a car accident that was not your fault, you may be entitled to obtain payment from a Public Insurer. You can get payment from the Insurance coverage Department, even if you were not responsible. It is always recommended that you consult with an Insurance policy Representative prior to making any choices concerning your claim. They can assist you via the cases process and aid you understand just how the procedure works.

Insurance policy Representatives are accredited by the state to work as Public Adjusters. You, the insurance holder, are assigned by the insurer to serve as the general public Insurer. She or he works exclusively for you and also has definitely no connections to the insurance provider. Consequently, the insurance provider will usually assign its best adjuster to handle its claims.

Insurance Agents have to adhere to strict rules and also laws. If you have concerns worrying an insurance claim, you must guide them to the insurance claims department. You should supply correct recognition as well as supply duplicates of records such as your insurance coverage, invoices, and so on. In addition, you must continue to be calm and also cooperative and also do not chew out the insurer. A good public adjuster will help you with these points and keep you educated.

Public Adjusters will evaluate your insurance claim and take action in a timely fashion. Insurance Companies want to resolve as quick as feasible due to the fact that they do not want to have to pay the excess expenses related to extensive lawsuits. Insurer hire qualified public insurers on a part-time or permanent basis. Part time workers will be in charge of cases, while full-time workers will concentrate on working as many insurance claims as feasible. Most notably, a good public insurance adjuster has access to the right get in touches with as well as will utilize this expertise to negotiate lower payment on your behalf.

If you are taking into consideration making use of the services of an expert public adjuster, ask to examine recommendations. See to it that they have a proven performance history of exceptional customer service. Inspect their client checklist to guarantee that they have had a good settlement price in the past. You must additionally examine referrals from other clients that are satisfied with their solutions.

Once you have actually chosen to collaborate with a reliable cases insurance adjuster, make certain to connect consistently with your insurer. Educate the insurance adjuster of any kind of changes that may take place throughout the procedure. Maintain all interaction lines open with your insurance provider. Likewise, ensure that you really feel comfortable allowing your insurance adjuster know of any kind of worries that you have. The good public insurers will certainly always pay attention to your concerns and provide you comprehensive suggestions. If you are having trouble connecting with your insurance adjuster, it is necessary that you discover a person that wants and able to connect well with you.

Some insurer like to employ real loss adjusters over independent brokers. https://www.sun-sentinel.com/business/fl-bz-hurricane-insurance-myths-and-facts-20180509-story.html is because they really feel more comfy recognizing that the broker is benefiting the insurance company rather than a specific claim adjuster. However, when an insurer hires a real loss adjuster, they retain the rights to use him or her in any type of future dealings with your insurance company. For the most part, if you are handling an independent broker, she or he is not the same person who will certainly be managing your insurance claim. This indicates that an independent broker can not provide you suggestions concerning your real loss scenario.

If you choose to collaborate with a professional public insurance adjuster, it is very important that you give them time to prepare your claim. The adjuster will usually request a detailed list of your home losses prior to they start dealing with your claim. They will also examine your insurance plan to make sure that the negotiation deal is fair as well as practical. If visit the following page is not appropriate to you, the insurance adjuster will likely ask for more time to gather info and create a suitable offer.

SPOILER ALERT!

What Does a Public Insurer Do And Exactly How Can They Assist You?

Written by-Borregaard Woods

Public insurance adjusters are independent public agents who work for insurance companies to aid individuals get all that they are qualified to from insurance policy conflicts. They assist in evaluating repair work and restoring expenditures, monitor the circulation of insurance policy earnings and claims, as well as connect with house insurance coverage providers to quicken their insurance claim authorizations. https://jfpublicadjusters.weebly.com/jf-public-adjusters-nj.html do not represent any type of specific firm or specific and also can not represent more than one insurance policy service provider. Their costs are generally identified by the quantity of damages, loss, or damage that happened. Insurance coverage representatives additionally obtain a portion of the last settlement or award amount if they negotiate settlement offers with an insurance policy carrier.

Insurance policies supply public adjusters with the authority to go into exclusive premises when essential in order to assist an insured customer with insurance policy matters. Insurance coverage service providers generally call for public insurers to get in personal premises in order to refine a case. In the event that an insurance policy holder violates this regulation, they can be held personally liable for the prices of problems they create. Additionally, they may encounter severe legal consequences for ignoring the civil liberties of others in their organization.

Insurance policy premiums and also loss negotiations vary considerably from one state to another. The price of insurance policy protection varies according per insurer's danger aspects and also costs. Insurance coverage service providers might decline to issue a plan or fee higher premiums than needed if a public adjuster is not utilized to refine a claim. If an insured person does not possess sufficient evidence of loss to sustain a negotiation, they might not be qualified to recover funds.

Insurance carriers utilize numerous approaches to identify the amount of the loss that should be supported in a settlement. Normally, insurance companies make use of a price quote of the substitute costs that result from the day of loss. Estimates are ready based upon historical information. In order to get quotes from numerous different firms, a customer should contact several insurance policy carriers. A qualified public adjuster will generally meet an insured client to discuss the specifics of their insurance policy case. The insured agent will certainly after that give the info called for in order to refine the case.

hop over to this website of the work carried out by a public adjuster varies depending upon the claims history of the guaranteed. Occasionally losses will certainly involve substantial home damage. Other times the work will certainly concentrate on less expensive resources of loss.

The dimension of the loss ought to establish the quantity of funds that should be paid out by the adjuster. Insurance policy claims involving residential or commercial property damage generally include huge quantities of cash. Insurance policy providers will usually call for homeowners to offer substantial proof of loss prior to a negotiation can be agreed upon.

In order to support an insurance policy case, it is necessary for the adjuster to have sensible evidence of a loss. Oftentimes a loss of this nature may require months or perhaps years to reach a negotiation. Insurance suppliers are not required to wait until a particular period has come on order to send such evidence. However, a request should be sent within a sensible timespan in order for an insurance claim to be considered practical.

When there is a loss entailing personal property, a house owner or various other property owner might agree with the insurance adjuster to enter into a contract. Such an arrangement can define what damages the insured is responsible for covering. The conditions of the arrangement can vary considerably. It is important that house owners make themselves familiar with any kind of contracts they enter into with their insurers. An ask for such details ought to be made to the adjuster at any time throughout the case process. The terms and conditions agreed upon can affect the negotiation in lots of methods.

Public insurance adjusters are independent public agents who work for insurance companies to aid individuals get all that they are qualified to from insurance policy conflicts. They assist in evaluating repair work and restoring expenditures, monitor the circulation of insurance policy earnings and claims, as well as connect with house insurance coverage providers to quicken their insurance claim authorizations. https://jfpublicadjusters.weebly.com/jf-public-adjusters-nj.html do not represent any type of specific firm or specific and also can not represent more than one insurance policy service provider. Their costs are generally identified by the quantity of damages, loss, or damage that happened. Insurance coverage representatives additionally obtain a portion of the last settlement or award amount if they negotiate settlement offers with an insurance policy carrier.

Insurance policies supply public adjusters with the authority to go into exclusive premises when essential in order to assist an insured customer with insurance policy matters. Insurance coverage service providers generally call for public insurers to get in personal premises in order to refine a case. In the event that an insurance policy holder violates this regulation, they can be held personally liable for the prices of problems they create. Additionally, they may encounter severe legal consequences for ignoring the civil liberties of others in their organization.

Insurance policy premiums and also loss negotiations vary considerably from one state to another. The price of insurance policy protection varies according per insurer's danger aspects and also costs. Insurance coverage service providers might decline to issue a plan or fee higher premiums than needed if a public adjuster is not utilized to refine a claim. If an insured person does not possess sufficient evidence of loss to sustain a negotiation, they might not be qualified to recover funds.

Insurance carriers utilize numerous approaches to identify the amount of the loss that should be supported in a settlement. Normally, insurance companies make use of a price quote of the substitute costs that result from the day of loss. Estimates are ready based upon historical information. In order to get quotes from numerous different firms, a customer should contact several insurance policy carriers. A qualified public adjuster will generally meet an insured client to discuss the specifics of their insurance policy case. The insured agent will certainly after that give the info called for in order to refine the case.

hop over to this website of the work carried out by a public adjuster varies depending upon the claims history of the guaranteed. Occasionally losses will certainly involve substantial home damage. Other times the work will certainly concentrate on less expensive resources of loss.

The dimension of the loss ought to establish the quantity of funds that should be paid out by the adjuster. Insurance policy claims involving residential or commercial property damage generally include huge quantities of cash. Insurance policy providers will usually call for homeowners to offer substantial proof of loss prior to a negotiation can be agreed upon.

In order to support an insurance policy case, it is necessary for the adjuster to have sensible evidence of a loss. Oftentimes a loss of this nature may require months or perhaps years to reach a negotiation. Insurance suppliers are not required to wait until a particular period has come on order to send such evidence. However, a request should be sent within a sensible timespan in order for an insurance claim to be considered practical.

When there is a loss entailing personal property, a house owner or various other property owner might agree with the insurance adjuster to enter into a contract. Such an arrangement can define what damages the insured is responsible for covering. The conditions of the arrangement can vary considerably. It is important that house owners make themselves familiar with any kind of contracts they enter into with their insurers. An ask for such details ought to be made to the adjuster at any time throughout the case process. The terms and conditions agreed upon can affect the negotiation in lots of methods.

SPOILER ALERT!

What is a Public Insurance Adjuster And Also Why You Required One?

Written by-Ivey Hedegaard

Claims made by locals in Florida have typically been submitted to a Public Insurance adjuster. These representatives carry out an essential role in the insurance policy market. Insurance claims submitted to them should be processed within a practical amount of time. Insurance claims will be either denied or authorized, dependent upon the kind of insurance claim submitted. One of the key functions of this representative is to help the customer with insurance claims that are in their benefit.

Claims reps work straight with clients to recognize their individual needs as well as tailor a distinct service to meet those requirements. They after that create a strategy with the customer to achieve that goal. In https://www.hotfrog.com/company/1441897292005376 , public insurance adjusters function individually, while others serve as reps for insurance provider or other governmental firms. Insurance policy asserts reps usually go through state training courses that present expertise about the insurance policy sector. Those called for to work as cases agents must be licensed by the Florida Department of Insurance.

Insurance claims agents work closely with insurance policy representatives and various other experts in order to refine the whole case. This may consist of gathering information from customers, filing paperwork, interacting with insurance companies, tracking repair work and reviewing photos as well as records. Cases reps are additionally responsible for making sure the accuracy of finished types and also completing any kind of needed reconciliation prior to making a final report to the client. A public adjuster executes additional functions such as performing quality control examinations as well as performing follow up examinations.

Insurance costs are based on many variables, such as the consumer's capacity to pay. The cases procedure has a direct impact on this price. Insurance coverage can either raise or decrease the complete amount of the plan costs paid for any kind of loss. In case of a huge loss, it is typically beneficial to have a public insurance adjuster evaluate and also review the claim to identify whether or not the plan will be enhanced.

Insurance companies rely heavily upon public insurance adjusters to manage their cases. Insurance provider make use of public insurance adjusters to help them figure out the value of a harmed building. Insurance policies can be adapted to show an accurate value of a home after an insurance coverage case has been submitted. After an Insurance policy Adjuster establishes the real problems of an insured home, the company will commonly request that the insured to pay an extra premium on the plan in order to cover the added costs.

Insurer must compensate for any type of loss that is directly related to the public's loss. Compensation for these prices may come in the kind of an increase to the policyholder's policy, or it may be available in the kind of an added charge on top of the normal costs. https://www.bakersfield.com/ap/national/minneapolis-on-edge-as-the-first-officer-charged-in-killing-of-george-floyd-goes-on/article_53bbc1a8-f9d7-5582-a3d7-fb03dad18152.html utilize the general public insurer to help them determine the settlement amount for each and every insurance claim. Policyholders should request an increase to the policy from the Insurance Company. If the insurance policy holder files a claim against the insurer with unreasonable premises, they could be displaced of service.

Insurance policies are enforced by public insurers either via class action suits or via private problems. The Insurer's primary purpose is to offer reasonable assurance to the insurance policy holders that they will certainly not be adversely influenced by the loss. In order to make a decision if the policyholder has actually provided a valid instance, an affordable amount of proof needs to be gathered. Insurance Company policyholders require to be mindful that they do not miss out on any important proof and that they receive all the settlement amounts they are entitled to.

Insurance coverage insurance holders need to not enable a public insurance insurer to bully them into going for a reduced settlement quantity. Actually, they need to ask the general public Insurance policy Adjuster to define specifically what the insurance holder has to submit to the insurance provider in order to settle the claim. The insurer need to have the ability to give the insurance policy holder a breakdown of points that they will certainly be spending for in the case of an event like this. The Public Insurance policy Insurer must additionally be able to supply a breakdown of exactly what the insurance policy holder will be in charge of if the insurance policy holder does not do well in getting a fair settlement.

Claims made by locals in Florida have typically been submitted to a Public Insurance adjuster. These representatives carry out an essential role in the insurance policy market. Insurance claims submitted to them should be processed within a practical amount of time. Insurance claims will be either denied or authorized, dependent upon the kind of insurance claim submitted. One of the key functions of this representative is to help the customer with insurance claims that are in their benefit.

Claims reps work straight with clients to recognize their individual needs as well as tailor a distinct service to meet those requirements. They after that create a strategy with the customer to achieve that goal. In https://www.hotfrog.com/company/1441897292005376 , public insurance adjusters function individually, while others serve as reps for insurance provider or other governmental firms. Insurance policy asserts reps usually go through state training courses that present expertise about the insurance policy sector. Those called for to work as cases agents must be licensed by the Florida Department of Insurance.

Insurance claims agents work closely with insurance policy representatives and various other experts in order to refine the whole case. This may consist of gathering information from customers, filing paperwork, interacting with insurance companies, tracking repair work and reviewing photos as well as records. Cases reps are additionally responsible for making sure the accuracy of finished types and also completing any kind of needed reconciliation prior to making a final report to the client. A public adjuster executes additional functions such as performing quality control examinations as well as performing follow up examinations.

Insurance costs are based on many variables, such as the consumer's capacity to pay. The cases procedure has a direct impact on this price. Insurance coverage can either raise or decrease the complete amount of the plan costs paid for any kind of loss. In case of a huge loss, it is typically beneficial to have a public insurance adjuster evaluate and also review the claim to identify whether or not the plan will be enhanced.

Insurance companies rely heavily upon public insurance adjusters to manage their cases. Insurance provider make use of public insurance adjusters to help them figure out the value of a harmed building. Insurance policies can be adapted to show an accurate value of a home after an insurance coverage case has been submitted. After an Insurance policy Adjuster establishes the real problems of an insured home, the company will commonly request that the insured to pay an extra premium on the plan in order to cover the added costs.

Insurer must compensate for any type of loss that is directly related to the public's loss. Compensation for these prices may come in the kind of an increase to the policyholder's policy, or it may be available in the kind of an added charge on top of the normal costs. https://www.bakersfield.com/ap/national/minneapolis-on-edge-as-the-first-officer-charged-in-killing-of-george-floyd-goes-on/article_53bbc1a8-f9d7-5582-a3d7-fb03dad18152.html utilize the general public insurer to help them determine the settlement amount for each and every insurance claim. Policyholders should request an increase to the policy from the Insurance Company. If the insurance policy holder files a claim against the insurer with unreasonable premises, they could be displaced of service.

Insurance policies are enforced by public insurers either via class action suits or via private problems. The Insurer's primary purpose is to offer reasonable assurance to the insurance policy holders that they will certainly not be adversely influenced by the loss. In order to make a decision if the policyholder has actually provided a valid instance, an affordable amount of proof needs to be gathered. Insurance Company policyholders require to be mindful that they do not miss out on any important proof and that they receive all the settlement amounts they are entitled to.

Insurance coverage insurance holders need to not enable a public insurance insurer to bully them into going for a reduced settlement quantity. Actually, they need to ask the general public Insurance policy Adjuster to define specifically what the insurance holder has to submit to the insurance provider in order to settle the claim. The insurer need to have the ability to give the insurance policy holder a breakdown of points that they will certainly be spending for in the case of an event like this. The Public Insurance policy Insurer must additionally be able to supply a breakdown of exactly what the insurance policy holder will be in charge of if the insurance policy holder does not do well in getting a fair settlement.

SPOILER ALERT!

What Does a Public Adjuster Do And Also Just How Can They Help You?

Written by-Woodard Walton

Public insurance adjusters are independent public representatives that help insurance firms to assist individuals get all that they are qualified to from insurance coverage disagreements. They aid in examining fixing and also restoring costs, keep track of the flow of insurance profits as well as insurance claims, as well as interact with house insurance coverage suppliers to speed up their claim authorizations. They do not represent any type of certain company or specific as well as can not stand for more than one insurance service provider. Their charges are commonly figured out by the amount of damage, loss, or damage that occurred. Insurance coverage agents likewise receive a portion of the last settlement or award amount if they discuss settlement provides with an insurance policy service provider.

Insurance plan provide public insurers with the authority to enter private properties when required in order to help an insured customer with insurance matters. Insurance policy service providers typically require public insurance adjusters to enter personal premises in order to process a claim. In https://www.law.com/dailybusinessreview/2020/08/31/anatomy-of-an-insurance-scam-citizens-property-florida-bar-detail-a-florida-lawyers-alleged-fraud/ breaches this policy, they can be held personally liable for the costs of problems they create. In addition, they may deal with serious legal repercussions for neglecting the civil liberties of others in their business.

Insurance policy premiums as well as loss settlements vary greatly from state to state. The expense of insurance coverage varies according to every insurer's risk variables and premiums. Insurance companies might refuse to release a policy or cost higher costs than called for if a public insurance adjuster is not used to refine an insurance claim. If an insured person does not have enough evidence of loss to support a negotiation, they might not be eligible to recuperate funds.